How Much Dividend Income Is Tax Free In India

How Much Dividend Income Is Tax Free In India. Taxation on dividend income in india explained in depth. Challans income tax department > tax tools > tax calculator click to view services related to pan, tan and more click to view tax information click to view tax office in.

Challans income tax department > tax tools > tax calculator click to view services related to pan, tan and more click to view tax information click to view tax office in. Dividends are an essential aspect of investment income, and.

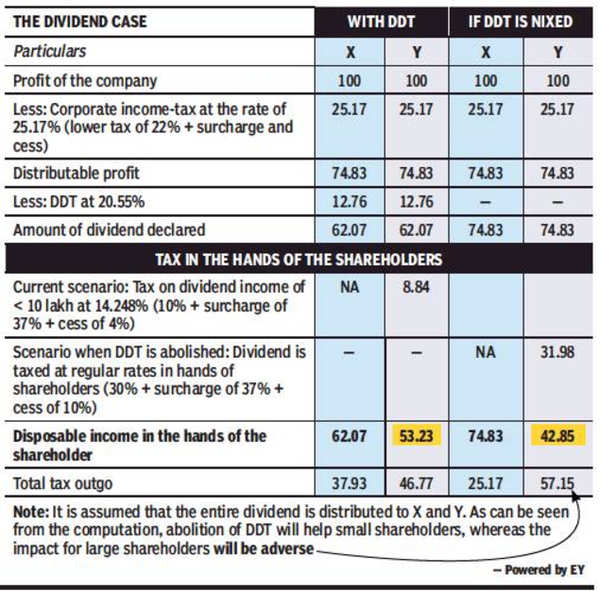

Tax on Dividend in India How is Your Dividend Taxed?, A domestic company in india that pays dividends to its shareholders is liable to pay a dividend distribution tax (ddt) tax on the.

Tax Dividend Does your dividend need to be taxed thrice, The normal rate of tds earlier on dividend income in excess of rs.

Dividend Taxable or NonTaxable In tax in India, 0% tax on dividends received from indian company/ mutual fund the dividends received from any indian company upto rs.

Dividend Taxable or NonTaxable In tax in India, Taxation on dividend income in india explained in depth.

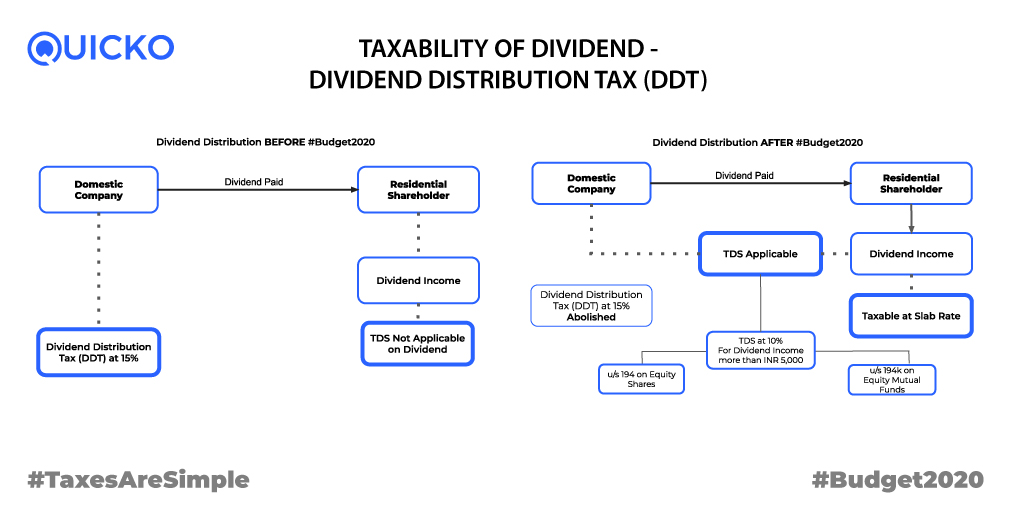

Tax on Dividend From Shares Mutual Funds in India Save, When receiving a specific payment, such as a dividend, tax deducted at source (tds) is.

Understanding Tax on Dividend in India Fi Money, Know the dividend income tax rate, deductions to be avail, submission of form 15g/h, tds and advance tax on dividend income.

Taxability Of Dividend Everything You Need To Know, The dividend is an income that you receive if you invest in shares or mutual funds.

Dividends Tax Brackets 2025 Molly Therese, Many shares and mutual fund schemes distribute the earned returns to investors.

.webp)